Loftium Helps You Buy A House In Exchange For Airbnb Revenue

In many cities throughout the US, people experience difficulties buying their first home without a good amount of savings built up or their parents chipping in. Seattle-based company Loftium may offer an interesting way out by providing customers with a substantial down payment in return for a share in their new house’s prospective Airbnb revenue.

Facing rising rents and student debts, first homeownership may seem an impossibility for many young people. If aspiring homeowners also cannot count on their parents to provide financial support, chances for finding a suitable place are quite dim. This is exactly the type of people that Loftium aims to target with its service. “It’s for the people who don’t have the parents to help, or the high income to save while paying rent,” said entrepreneur Yifan Zhang, who co-founded Loftium together with Adam Stelle.

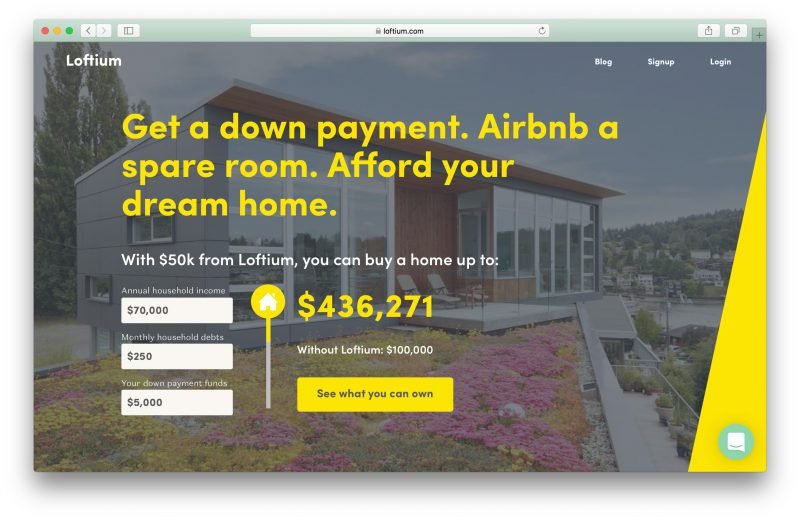

What is Loftium’s deal exactly? The company will provide prospective home buyers with a down payment of up to $50,000 as long as they agree to offer one of the house’s bedrooms on Airbnb for a period of three years after their purchase. Using an algorithm that predicts how much money can potentially be made from a room in a certain location, Loftium determines how large the offered down payment can be, customizing the contract for every customer.

Down payments are customized

The contract terms seem rather strict. The homeowners get to keep about one third of the generated income through renting out the room on Airbnb; the other two-thirds go to Loftium. Over the course of the 3-year contract period, customers have only 8 days per year where they are not obliged to have their room on offer on Airbnb and, should they want to terminate the contract earlier, they will have to front the remaining amount of money within a week. Also, if Loftium’s customers do not manage to pay back the loan provided, the company has the right to be second in line to be paid back after the house is sold. On the other hand, Loftium will make sure to make hosting people as easy as possible for its customers.

An example of how Loftium could make it easier to enter the home-buyers’ market

Loftium is currently running a small pilot in Seattle, where people that acquired a mortgage from Umpqua Bank can apply for a down payment. It eventually hopes to expand its services to other cities in the US too, working with a larger number of lenders and room rental services, so that it can provide more opportunities for people to engage in the homebuyers’ market. However, it remains to be seen whether Loftium’s business model is viable elsewhere too. Demand for its service needs to be strong enough in cities other than Seattle, homeowners need to prove themselves as trustworthy customers, and restrictive local legislation regarding Airbnb-type rental services that have been implemented in cities like New York, Barcelona, and Amsterdam could be a serious obstacle for Loftium.